New Study Finds JA Increases Students’ Financial Capability

September 15, 2023

Student teams in Singapore competed against one another during the National Innovation Challenge, part of the JA Building a Financially Capable Generation initiative.

According to an impact evaluation by FHI 360, students who participate in the JA Building a Financially Capable Generation learning experience gain valuable knowledge, skills, and attitudes for managing their financial health and well-being.

JA Building a Financially Capable Generation (BaFCG) is a learning experience developed in partnership with HSBC and implemented by JA locations worldwide. The BaFCG program enables participating students to “Recognize that increasing their knowledge, skills, and experience with money promotes self-confidence and relationships (in person and online) that support financial capability and personal resiliency.”

The learning experience uses three distinct and interrelated components to achieve this goal: (1) a foundational session that introduces relevant financial concepts, including savings, financial goals, and debt to students; (2) the FinQuest app and its quests, which allow the students to learn those concepts through an engaging game-based mobile application; and (3) an innovation challenge event that enables them to apply and discuss the topics in a competitive group setting. JA designed these components for students ages 12–16.

Throughout the initiative, JA Worldwide worked with FHI 360 to evaluate the learning experience and identify opportunities for improvement. JA applied the lessons learned to strengthen the initiative’s three components.

At the conclusion of the initiative’s fourth year, FHI 360 completed a summative evaluation to assess the correlation of the learning experience on student knowledge, attitude, behavioral intent, and self-efficacy related to financial capability. The evaluation also assessed the perceptions of volunteers, JA staff, and classroom educators regarding the learning experience and its effectiveness.

Methodology and Data Sources

Evaluators used a mixed-methods approach to evaluate JA Building a Financially Capable Generation, with researchers collecting student information through quantitative pre- and post-surveys and pre- and post-application quest quizzes. Volunteer information was collected through a quantitative survey. Volunteer, staff, and teacher perceptions were collected using informant interviews.

6,128 student surveys

6,748 FinQuest quizzes

94 volunteer surveys

28 volunteer interviews

15 JA locations

““In addition to learning about finances,

I learned about time management, collaboration, and creative thinking.

Most importantly, though, I learned how to be confident.””

Program Impacts on Student Knowledge, Attitudes, Behaviors, and Self-efficacy

Evaluators found statistically significant evidence that the BaFCG learning experience increased:

Knowledge scores related to financial capability

Attitude scores related to savings and insurance

Behavioral intent related to budgeting and using financial services in the future

Self-efficacy scores related to financial goals and money management

Student Perceptions of Program Benefits After Participation

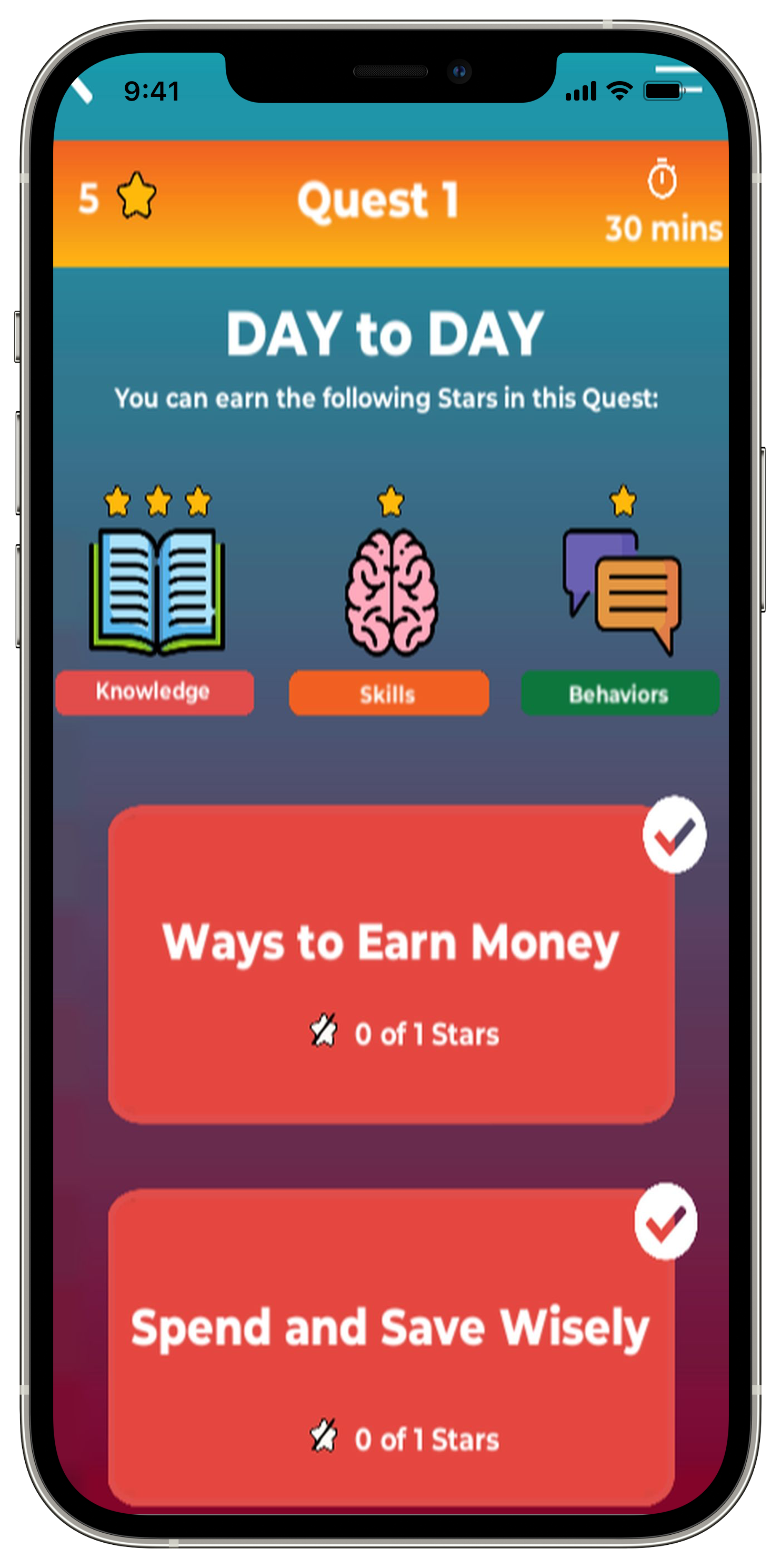

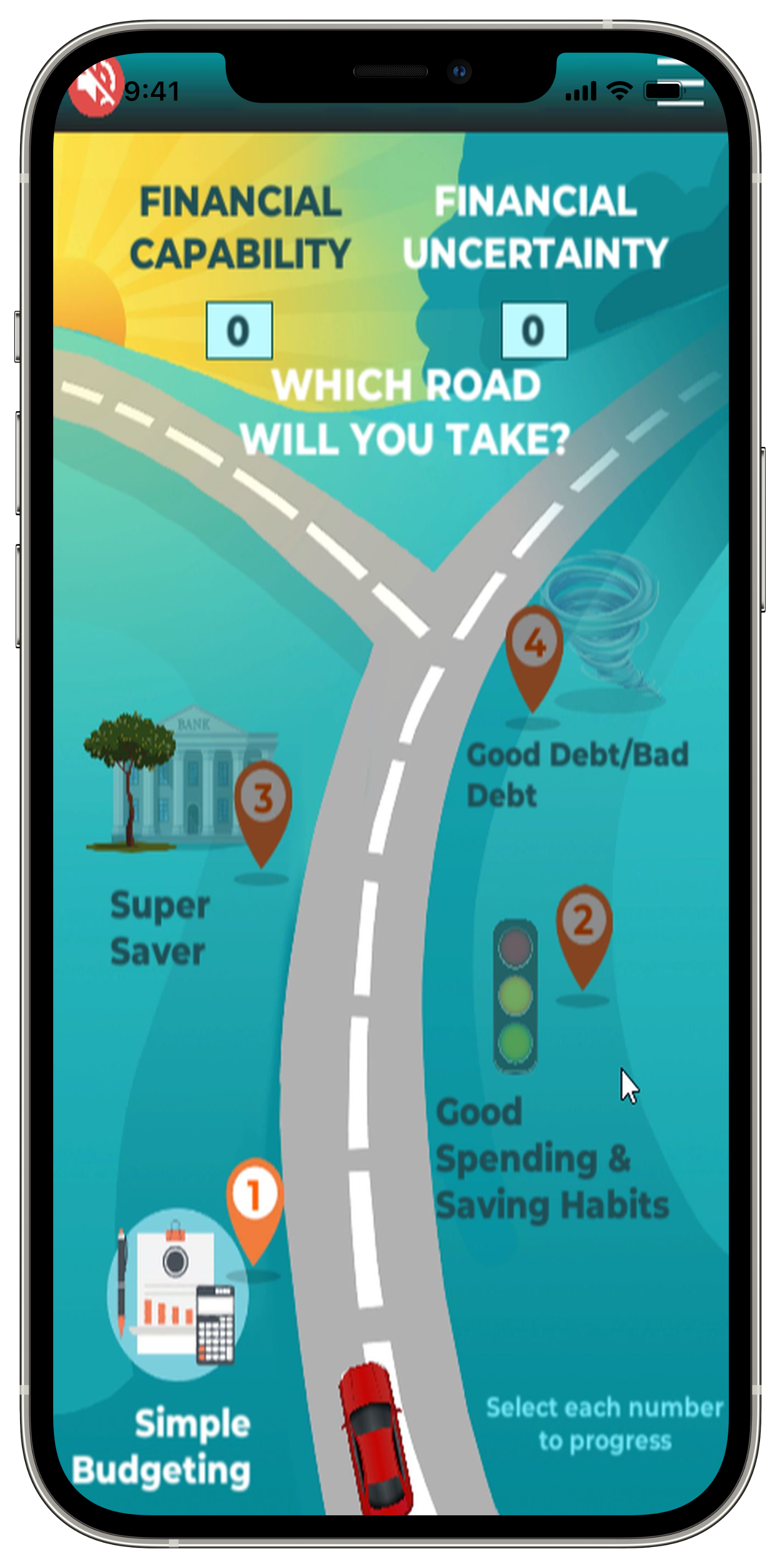

FinQuest App Effectiveness

Findings from pre- and post-quest quizzes within the FinQuest application showed that each quest generated statistically significant increases in student confidence, knowledge, and attitudes toward money.

FinQuest’s four quests include:

Quest 1, Day to Day: Gain foundational knowledge, skills, and attitudes to make smart financial decisions on a day-to-day basis.

Quest 2, Future Opportunities: Learn the basics of money management for long-term financial health and well-being.

Quest 3, Future Risk Management: Explore the advantages and disadvantages of financial services, such as loans and insurance.

Quest 4, Wrap-up: Participate in a game show called “Life Happens” that tests financial capability knowledge, skills, and attitudes.

Percent of Positive Responses

Volunteer Perceptions of App Effectiveness

Researchers asked volunteers which of FinQuest’s four quests is most effective. More than half (53%) cite Quest 1, Day to Day, as the most effective quest.

Most Effective Quest by Percent

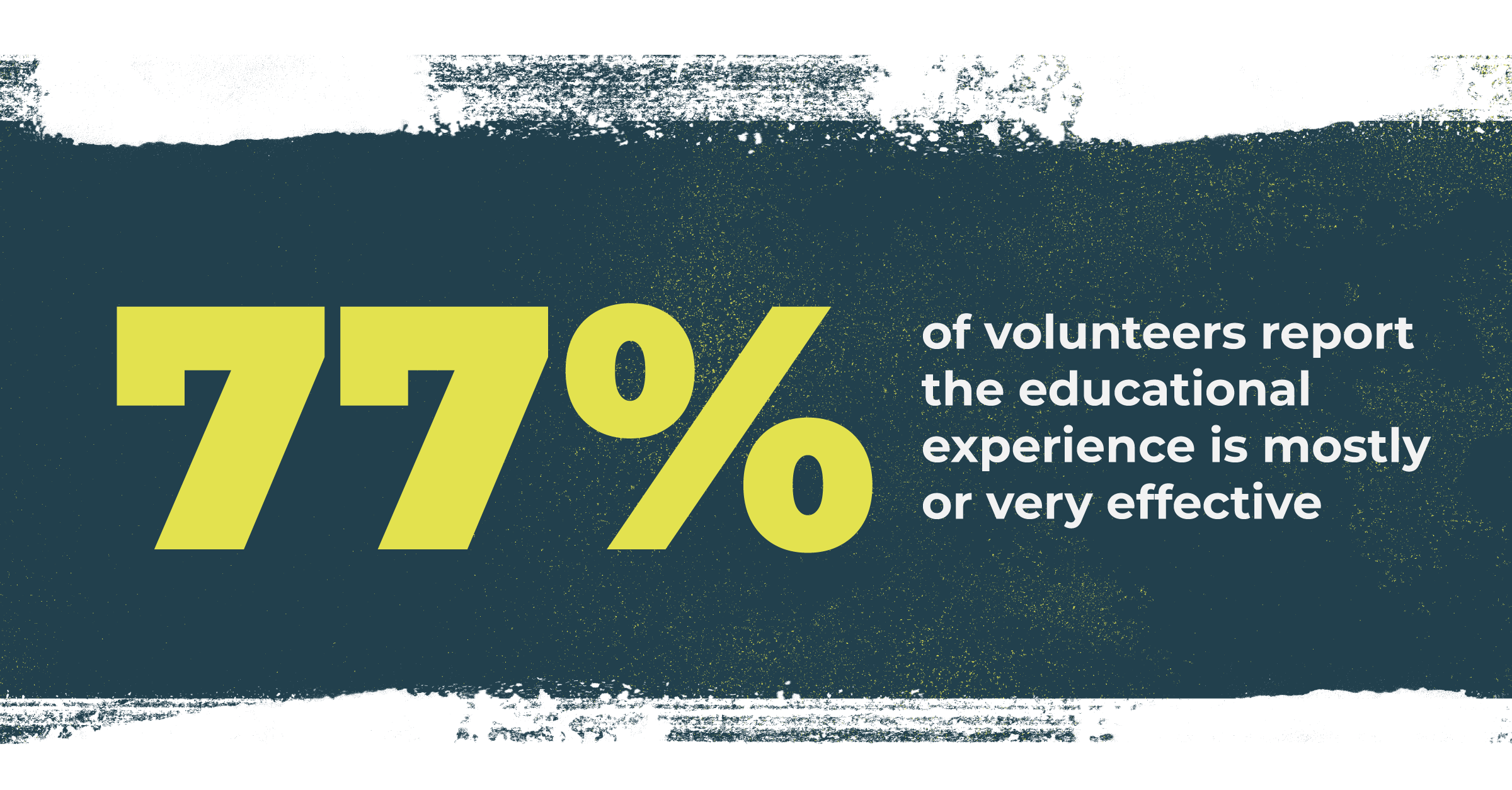

Volunteer and Staff Perceptions of Learning Experience Effectiveness

JA staff who managed the learning experience and volunteers who delivered each learning component largely found BaFCG to be successful. In interviews, respondents reported JA Worldwide created an engaging approach providing a financial foundation for youth—introducing concepts that will help them make smart, informed decisions now and in the future. Interview respondents observed advances in student engagement, knowledge, and attitudes, and even reported behavior changes, such as talking about their plans to save or rethinking their spending.

The National Innovation Challenge was especially exciting for students who worked in teams and exhibited creativity and work-readiness skills, including time management, communication, and collaboration. Volunteers reported hearing students discussing financial topics together in their free time and asking when they could participate in more sessions, further demonstrating the high level of engagement.

In addition to describing these successes, JA staff, volunteers, and teachers suggested incorporating relevant case studies to enhance the individualized learner experience and improve local connectivity issues. Overall, JA staff and volunteers found BaCFG to be a beneficial learning experience that introduces relevant practical knowledge at a critically important developmental age range.

Most Effective Program Component by Percent

““Students learn the financial skills and the financial knowledge that they need for the future. Whenever they need to make financial decisions, they already know what to do.””